"As riches increase and accumulate in few hands. . . the tendency of things will be to depart from the republican standard."-Alexander Hamilton

One of the things that I learned by

reading Atlas Shrugged last year is that, even in the mind of

America/Russia’s foremost social Darwinist, all rich people are not equal. For

every Dagny Taggart or Francisco d’Anconia creating wealth wealth and adding

value to the world, Rand shows us a James Taggart or a Wesley Mouch amassing

a large fortune without producing anything of value. Those in the second class

of millionaire create neither wealth nor jobs; rather, they harness the power

of the state to distribute existing wealth in ways that favor their private

interests. Rand refers to these people as “looters.”

One of the things that I learned by

reading Atlas Shrugged last year is that, even in the mind of

America/Russia’s foremost social Darwinist, all rich people are not equal. For

every Dagny Taggart or Francisco d’Anconia creating wealth wealth and adding

value to the world, Rand shows us a James Taggart or a Wesley Mouch amassing

a large fortune without producing anything of value. Those in the second class

of millionaire create neither wealth nor jobs; rather, they harness the power

of the state to distribute existing wealth in ways that favor their private

interests. Rand refers to these people as “looters.”

I did not know until I read Joseph

Stigletz’s wonderful new book, The Price of Inequality, that economists have a word for this too. Trying to profit by capturing, rather than creating wealth is called

“rent seeking,” using a very old sense of the word “rent” that means something

like “seeking concessions” rather than “deriving income from property.” Rent

seeking refers to any economic activity that attempts to manipulate political

or social conditions to lay claim to a larger share of a society’s wealth.

Today, rent-seeking activities include no-bid government contracts, special tax incentives, sanctioned monopolies, competitive barriers, legal immunities, infrastructural improvements, and regulatory relief that shifts resources away from one part of the economy and towards another. Rent seeking also occurs when economic activity imposes costs on others that are not charged against profits--such as, say, a company that creates air pollution but is not charged for treating respiratory diseases that occur as a result. Countless other industries--from pornographers to investment bankers to for-profit colleges--realize profits far in excess of their value by shifting costs (failed marriages, increased economic risk, and student loan defaults) to society and government, who are forced to pick up the tab.

Rent seekers have been with us always. But Stiglitz sees rent-seeking activities as both a primary cause for, and as the inevitable result of, the most recent “great recession.” Those who profited from the real-estate bubble and from complicated financial derivatives were not, by any stretch of the imagination, creating wealth. They were reaping huge profits by transferring economic risk to the public sector while keeping nearly all of the profits in the private sector. As result, the people who have paid the highest economic costs of the recession (losing their jobs or their houses) are not the same people whose economic activities are the most to blame.

But what really interests Stiglitz (and me too) is what has happened since the crash of 2008. According to a certain narrative, the only way out of the recession is to cut taxes dramatically and put as much money as possible into the hands of job creators—business owners and innovators who have the intelligence and the inclination to use that extra money to create jobs and move the lagging economy forward. And, to a large extent, this is what we have tried to do.

But it hasn’t worked very well. Look at the following chart, which shows how some key economic indicators have fluctuated in the years before and after the great crash:

Today, rent-seeking activities include no-bid government contracts, special tax incentives, sanctioned monopolies, competitive barriers, legal immunities, infrastructural improvements, and regulatory relief that shifts resources away from one part of the economy and towards another. Rent seeking also occurs when economic activity imposes costs on others that are not charged against profits--such as, say, a company that creates air pollution but is not charged for treating respiratory diseases that occur as a result. Countless other industries--from pornographers to investment bankers to for-profit colleges--realize profits far in excess of their value by shifting costs (failed marriages, increased economic risk, and student loan defaults) to society and government, who are forced to pick up the tab.

Rent seekers have been with us always. But Stiglitz sees rent-seeking activities as both a primary cause for, and as the inevitable result of, the most recent “great recession.” Those who profited from the real-estate bubble and from complicated financial derivatives were not, by any stretch of the imagination, creating wealth. They were reaping huge profits by transferring economic risk to the public sector while keeping nearly all of the profits in the private sector. As result, the people who have paid the highest economic costs of the recession (losing their jobs or their houses) are not the same people whose economic activities are the most to blame.

But what really interests Stiglitz (and me too) is what has happened since the crash of 2008. According to a certain narrative, the only way out of the recession is to cut taxes dramatically and put as much money as possible into the hands of job creators—business owners and innovators who have the intelligence and the inclination to use that extra money to create jobs and move the lagging economy forward. And, to a large extent, this is what we have tried to do.

But it hasn’t worked very well. Look at the following chart, which shows how some key economic indicators have fluctuated in the years before and after the great crash:

Bottom Fifth Income

|

Top Fifth Income

|

Top 1 % Income

|

GDP (IN TRILLIONS) ON 6/30

|

UNEMPLOYMENT RATE ON JUNE 30

|

PERSONAL INCOME TAX AS % OF GDP

|

TOTAL CORPORATE TAX AS % OF GDP

|

|

2006

|

11,352

|

168,170

|

297,405

|

13.33

|

4.60

|

7.90%

|

2.70%

|

2007

|

11,551

|

167,971

|

287,191

|

13.98

|

4.60

|

8.40%

|

2.70%

|

2008

|

11,656

|

171,057

|

294,709

|

14.42

|

5.60

|

8.00%

|

2.10%

|

2009

|

11,552

|

170,844

|

295,388

|

13.89

|

9.50

|

6.60%

|

1.00%

|

2010

|

10,994

|

169,391

|

287,201

|

14.41

|

9.40

|

6.30%

|

1.30%

|

2011

|

11,239

|

178,020

|

311,444

|

15.59

|

9.10

|

7.30%

|

1.20%

|

Notice anything interesting? Here are a

few things that popped for me:

- The bottom 20% of wage earners have not yet caught up to where they were in 2006.

- The top 20% of wage earners are much better off than they were before the recession began, as are the top 1%.

- The GDP has recovered from the recession and continues to grow.

- The federal tax burden remains lower than it was before the recession began.

- Unemployment in 2011 was nearly twice what it was before the recession began.

Let us add to these facts a rather stunning figure that Stiglitz cites, which is that, between 2009 and 2011, the top 1% of wage captured 93% of the income

growth (compared to 65% between 2000 and 2007). The (admittedly oversimplified) bottom line goes something like this: we successfully transferred a lot of money rich people, and they kept it. If Stiglitz is correct, this happened because the aforementioned rich people were engaged in economic activity aimed at capturing, rather than creating, wealth.

And this kind of social inequality founded on rent-seeking has real consequences, the most important being that, when wealth is simply redistributed upwards, there is nothing that can trickle down or create jobs. Neither Stiglitz nor anybody else suggests that we can or should get rid of inequality. He is not a Marxist or even a particularly committed redistributionist. He believes that markets have tremendous power to create and distribute wealth. But unregulated markets will always flow towards deep inequalities of wealth and income. Like so many other good things (chocolate, oxygen, and close relatives to name a few), capitalism works best when it is diluted.

And this kind of social inequality founded on rent-seeking has real consequences, the most important being that, when wealth is simply redistributed upwards, there is nothing that can trickle down or create jobs. Neither Stiglitz nor anybody else suggests that we can or should get rid of inequality. He is not a Marxist or even a particularly committed redistributionist. He believes that markets have tremendous power to create and distribute wealth. But unregulated markets will always flow towards deep inequalities of wealth and income. Like so many other good things (chocolate, oxygen, and close relatives to name a few), capitalism works best when it is diluted.

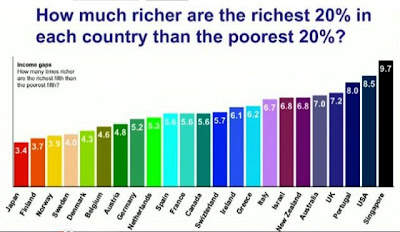

Inequality

in America is worse now than it has been since the late 19th

century, when factory workers were paid in company script and the most

important industry in the Southern states was sharecropping. The distribution

of wealth in the United States (as measured by the Gini coefficient) is about

as unequal as it is in Iran and far less equal than it is in nearly every other

country in the Industrialized West. In the long term, this will have serious

consequences for America. High levels of income inequality are incompatible

with political stability, public investment, and long-term expansion. And in the process, we risk creating precisely the kind of self-perpetuating, multi-generational

aristocracy that America was founded not to be.